Is real estate investment trusts a good career path? Are you considering a career in the real estate industry? Delve into this exciting profession, full of possibility and potential for rewards.

Invest in a variety of real estate types with ease. With Real Estate Investment Trusts or REITs, you can own a fraction of several different property portfolios.

Investing in a Real Estate Investment Trust (REIT) is an attractive opportunity for career-minded individuals looking to increase their portfolio diversity.

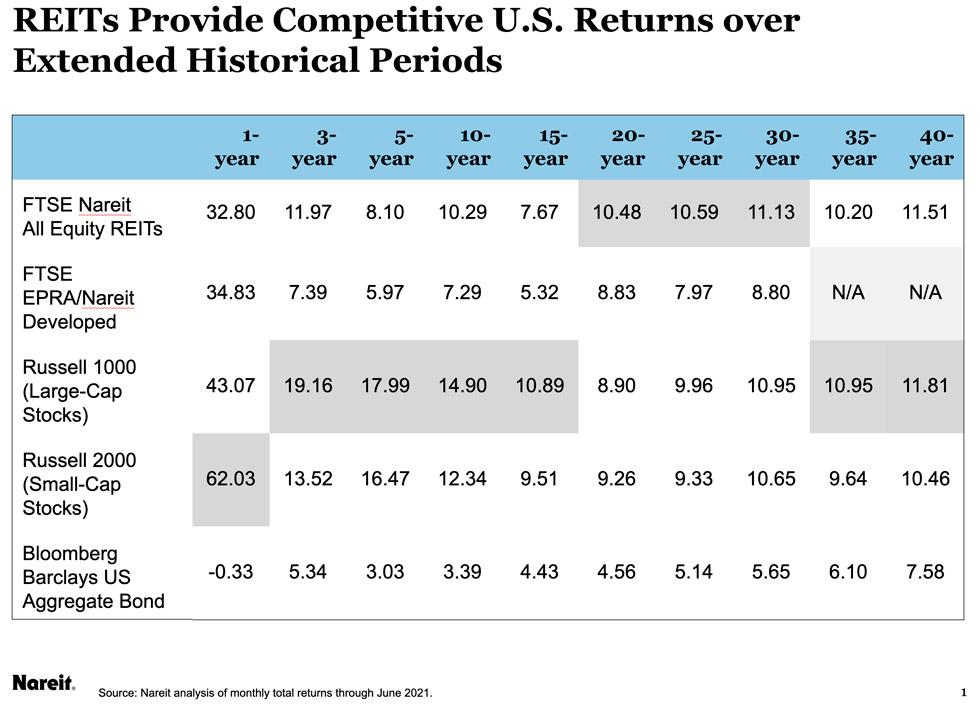

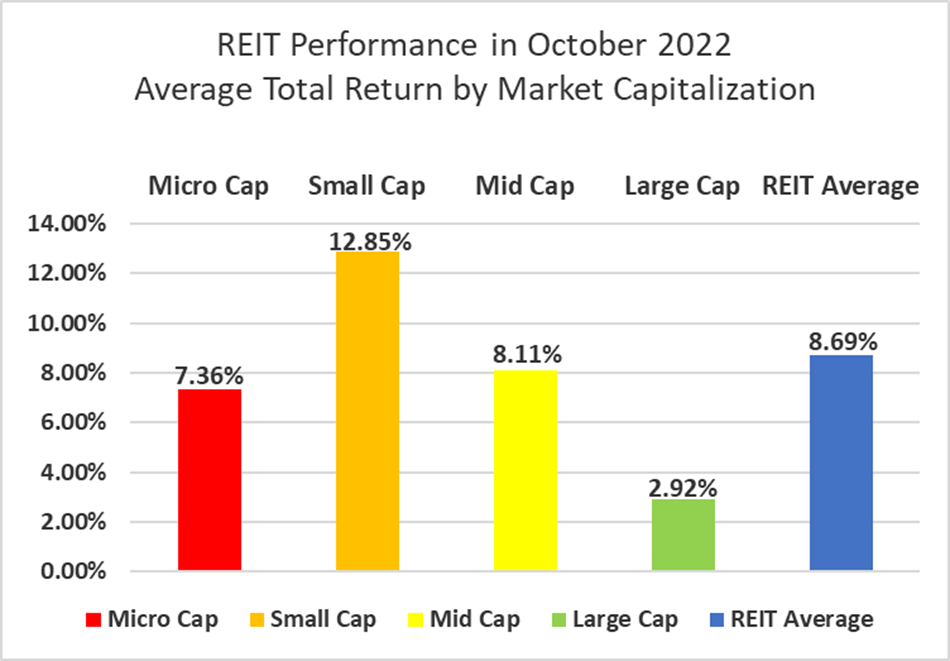

With over 60 years of solid growth and currently holding around $1.25 trillion market value, REITs are amongst the most lucrative investments available within the U.S., offering stability and potential rewards second to none.

Real estate investment trusts actively seek talented managers to help shape the commercial real estate landscape. You can contribute substantially and make a lasting impression on this ever-evolving field with your expertise.

As the world of work evolves, today’s entrants into the job market have more career paths than ever. But this surge in opportunity also needs to be clarified – there are many different elements to consider when choosing a profession.

FixTheLife’s Career Path Series dives into many professions and options to help you determine your best fit. Our latest work focuses on “is real estate investment trusts a good career path”, bringing clarity to the decision process for aspiring professionals.

Interested in pursuing a career path in real estate investment trusts? Let’s uncover the details and see if this route is right for you.

ALSO READ: How Many Jobs are Available in Real Estate investment Trusts

Key Points Summary on – Is Real Estate Investment Trusts a Good Career Path Article

- Real estate investments can be an exciting and rewarding career; however, it demands a certain risk tolerance. REITs offer the potential for high returns, but poor investment decisions could lead to great losses – making caution essential when entering this field.

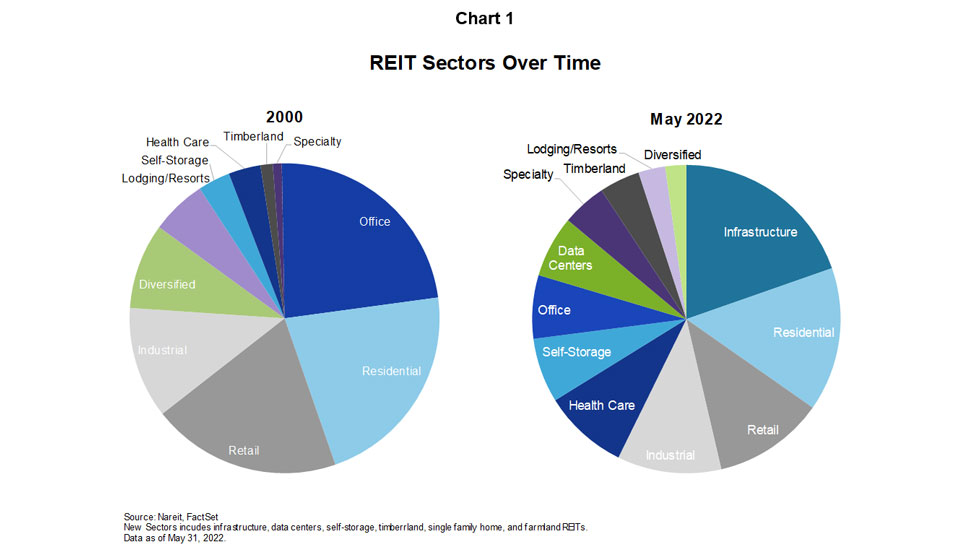

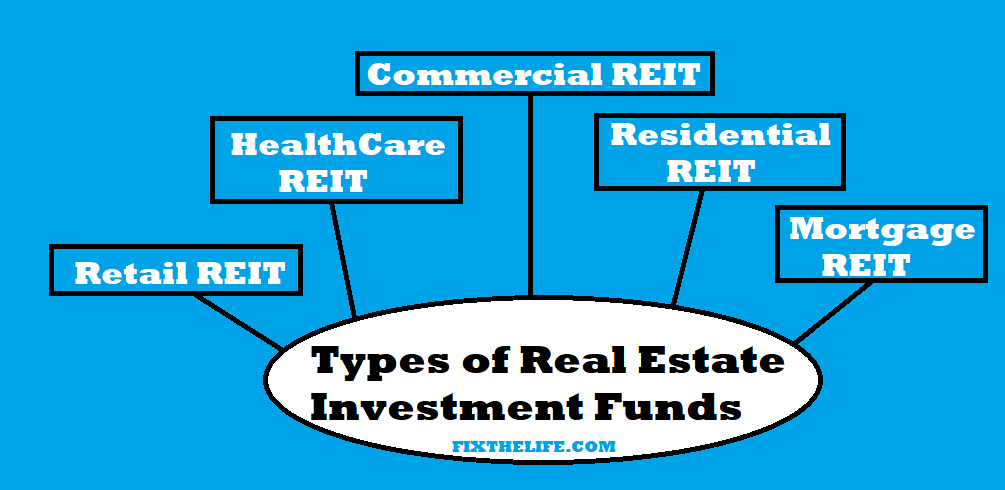

- Real estate investment trusts offer investors diverse opportunities, whether retail, residential, healthcare, or office-based investments they’re looking for – as well as in publicly traded and non-traded securities. For those seeking more complex strategies, there are also private REITs available.

- Real estate investment trusts provide various career opportunities, including property managers overseeing properties, development executives in charge of construction projects, and real estate agents who find tenants. Asset managers are also sought after to acquire investments, while asset acquirement is required to maintain them.

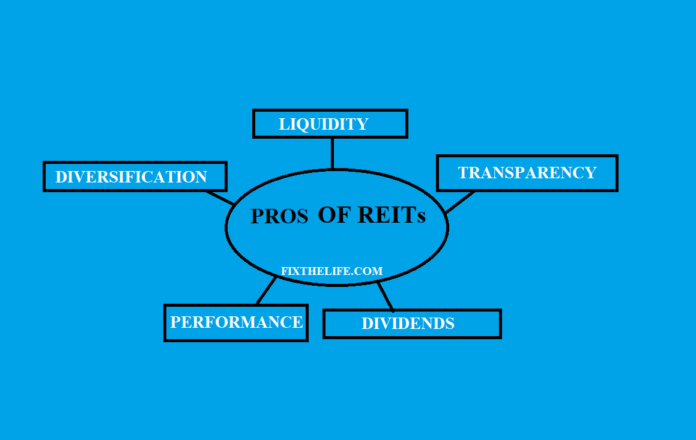

- Investing in this industry has countless benefits. Market liquidity, performance excellence, and dividend yields provide the investor with immediate returns, while diversified portfolios offer lasting value over time to secure a bright financial future.

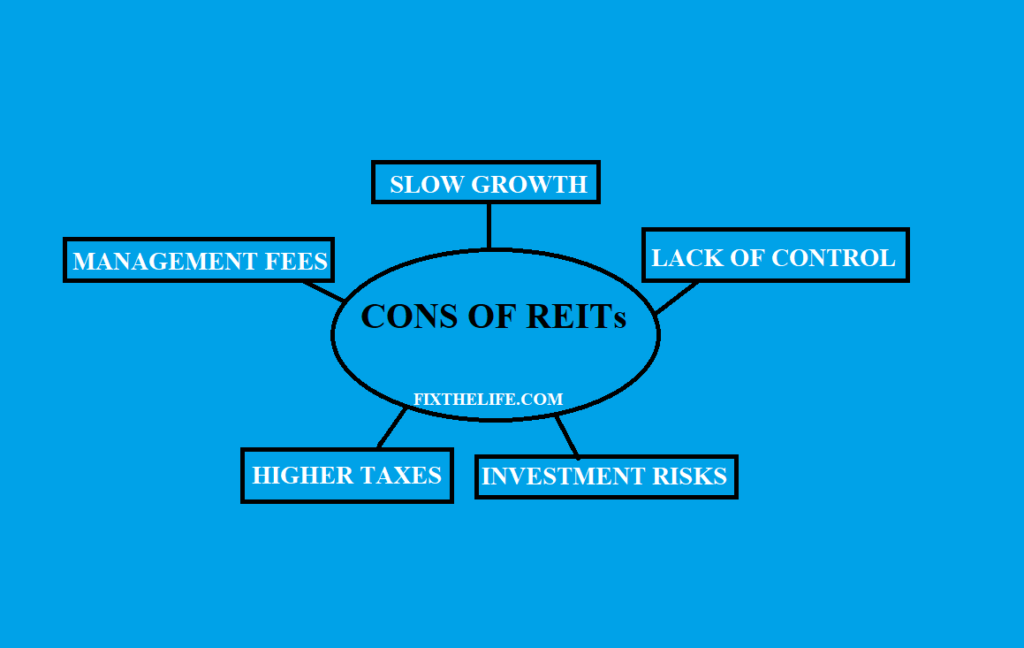

- This industry faces a considerable challenge due to sluggish growth, hefty taxes, and management fees, with limited control over investments accompanied by inherent risks.

- Investment in REITs is a sure path to success, with 83% of financial advisors advocating that their clients pursue them.

Let us get started, discovering what lies ahead.

What Are Real Estate Investment Trusts?

A real estate investment trust (REIT) is an attractive choice for investors looking to diversify their portfolios.

Unlike traditional stocks and bonds, REITs generate income by selling real estate assets – offering growth potential with added security from regulatory oversight.

For investors looking to benefit from real estate ownership, purchasing shares in a Real Estate Investment Trust (REIT) can be attractive.

Through REITs, individuals can access large-scale properties such as apartment buildings and commercial ventures that could prove difficult or costly.

REITs provide an ideal solution for those looking to benefit from real estate investments without the hassle of managing or owning any buildings.

Real estate investment trusts offer investors a lucrative way to benefit from income-generating real estate. These funds and securities provide exciting opportunities for growth in the world of property investments.

Investors have the opportunity to invest in a variety of projects, from hospitals and schools to warehouses and hotels.

By investing with investment trusts that receive government tax reductions, investors can look forward to greater returns for their money.

Trading REITs is a great way to invest, offering investors the ability to purchase and sell shares like they would with any mutual fund.

REITs offer investors a unique advantage: the ability to preserve liquidity without burdening their portfolio with single-family home ownership.

REITs must reward their shareholders with 90% profits while reinvesting the remainder for further growth. This could include expansion through real estate acquisition or additional investments to increase shareholder value.

REITs offer complementary benefits to investors – gains from asset management and staff oversight. This is why publicly-traded REITs are often more profitable than non-traded ones, as noted by the SEC.

Non-traded REITs rely on external firms to manage their properties, utilizing expert property management services.

Types of Real Estate Investment Trusts

Investing in Real Estate Investment Trusts (REITs) could be a great career avenue, so let’s dive into the different types of REIT structures and uncover how they might deliver returns.

Tired of buying stocks? Consider investing in real estate through Equity Real Estate Investment Trusts.

This investment allows you to purchase and manage income-generating properties like office spaces, warehouses, and hotels—all while earning dividends from tenant rents shared among shareholders.

To help you get started in this space here’s some essential information on four different types of REITs available.

Retail Real Estate Investment Trusts

Investment trusts offer lucrative opportunities for business owners to set up shop in prime shopping and commercial areas. Through leasing retail spaces, boutiques and grocery stores can easily find a well-suited location at an ideal price point.

Investing in real estate can be an excellent way to amplify returns, as the market for these properties is always growing.

It’s important to bring together a team that knows its stuff when dealing with property investments to capitalize on this opportunity and ensure the successful management of assets.

When selecting a tenant to inhabit their trust, landlords should carefully weigh retailers’ financial stability and propensity for success.

Choosing trusted brands in stable industries, such as groceries or home improvement stores, helps ensure that rent payments remain dependable over time.

Residential Real Estate Investment Trusts

Invest in the future with this reliable real estate trust, which manages a portfolio of well-maintained rental properties.

As a source of income and wealth generation, REITs are an attractive option for many investors.

The potential returns come with inherent risks, namely the risk associated with shifting housing markets, financing availability, cost changeability, and oversupply in some areas or circumstances coupled with fluctuations in interest rates.

For residential real estate investment trusts, larger urban areas remain the focus due to their consistent and favorable performance in low-supply yet high-demand markets.

Healthcare Real Estate Investment Trusts

Investing in healthcare facilities can be a lucrative and secure strategy for long-term growth.

With investment trusts focused on clinics, care homes, and hospitals, you have the potential to maximize your returns with reliable investments that benefit society as well.

Investment growth in healthcare relies on the availability of necessary funds and occupancy rates. High-performance facilities can witness an upsurge, while low-occupancy ones may require additional resources to attract investors.

Office Real Estate Investment Trusts

REITs offer a tremendous upside without the usual risks associated with real estate, making them an attractive investment option for businesses.

For netting a reliable income, investing in office trusts is the way to go. Leases are longer-term with tenants occupying these hubs located primarily within developing cities.

However, one should consider factors such as economic status, joblessness, and even occupancy rates when evaluating any potential returns from this venture.

Mortgage Real Estate Investment Trusts

Trusts offer steady investment opportunities to those in real estate by granting loans or purchasing mortgage-backed securities.

Investors reap the rewards through the difference between interest earned on these mortgages and their funding costs.

Keeping a close eye on trust finance is essential, and analysts and investors ensure no detail goes overlooked when examining financial statements.

Hybrid Real Estate Investment Trusts

This unique mix of equity and mortgage real estate investment trusts allows investors to diversify their portfolios by investing in both properties and extending loans to other property owners.

This approach allows for a greater return on investments while providing meaningful opportunities within the industry.

Real estate investment trusts (REITs) can be classified based on their ownership structure, with dividends earned from rental income, capital gains, and mortgage interest. Investing in such securities offers the potential for steady returns over time.

Based on ownership, the real estate investment trusts are classified into:

Publicly Traded Real Estate Investment Trusts

The US SEC oversees the trading of Real Estate Investment Trusts (REITs) on a nationwide exchange, allowing individual investors to purchase and sell shares in these investment opportunities.

Public Non-Traded Real Estate Investment Trusts

Investment trusts, overseen by the SEC, offer investors heightened stability due to their lack of liquidity.

Unlike traditional securities exchanges, which are subject to market fluctuations, these investments provide a safe and dependable source for growth potential.

Private Real Estate Investment Trusts

Investing in real estate funds offers unique opportunities, but these investments are reserved exclusively for institutional buyers and do not benefit from SEC oversight.

However, no matter what type of fund is chosen, all investors can rest assured that their investment will be subject to the same standards.

Is Real Estate Investment Trusts A Good Career Path?

Are you interested in entering a real estate investment trust as a career? Evaluate if this occupation suits your skills and motivations to make an informed decision.

Although a friend’s success in REITs may seem appealing, it does not necessarily mean that this profession is the right fit for everyone. It is important to consider your strengths and weaknesses before committing to any new career.

It’s important to know the advantages and disadvantages of making a wise investment in real estate trusts. Without this understanding, getting “yes” or “no” isn’t enough for success.

REITs present an interesting investment proposition, especially for experienced investors.

However, it’s important to remember that investing in REITs comes with risks and should be undertaken only after a professional investor carefully analyzes one’s goals and objectives.

REITs may be an ideal career option for those passionate about real estate and with the financial acumen to make it work.

Investing in this market involves calculated risks that can yield substantial rewards when approached strategically.

As a REIT agent, you’ve got the chance to give investors an opportunity – to own real estate, which could be the stepping stone to financial success.

What to Expect in a Real Estate Investment Trusts Career Path?

Working in Real Estate Investment Trusts (REITs) can provide aspiring professionals with a unique, lucrative career path. Different REIT types exist, each offering distinct investment goals and strategies that come with their risks to consider.

If you’re considering pursuing a career within the industry, here are some potential benefits – or drawbacks – for your consideration.

Investing in a real estate investment trust (REIT) requires thorough research and knowledge of the applicable regulations. As these vary depending on the jurisdiction, you must meet rules and requirements for successful REIT operations.

Investing in Real Estate Investment Trusts (REIT) requires substantial capital and experience but can provide lucrative returns for those that make it past the high entry barrier.

Established investors can grow their earnings and explore positive growth opportunities.

REITs are a great option if you’re looking for an investment opportunity in the real estate sector.

You’ll need to have enthusiasm about generating income from property holdings and see it as more than just finance – but if that sounds like your cup of tea, there are plenty of lucrative possibilities.

Requirements to Manage The Real Estate Investment Trust?

With real estate investment trusts, anyone from large institutions to individual investors can gain a piece of the property pie.

Like mutual funds, REITs offer an easy and cost-effective way for savvy individuals to add diversified real estate holdings into their portfolios.

Rules and regulations provide a gateway to lucrative investment opportunities with the potential for high returns.

Before entering the real estate field, it is important to understand a few key guidelines. Knowing these pieces of advice can help ensure your success in this competitive industry and get you one step closer to achieving your goals.

- Real estate investment trusts must maintain a large public presence, with at least 100 shareholders, to ensure diverse ownership. Moreover, every person can hold up to half of the trust’s shares to prevent any entity from gaining complete control.

- The trust must reward shareholders handsomely. As per SEC, at least 90% of a company’s taxable income is to be distributed amongst them in the form of dividends.

- For real estate investors to qualify, more than 75% of their earnings must come from rent or sales.

- Investors must ensure that their portfolios comprise real estate, cash, and treasury investments.

- Executives must navigate the complexities of real estate investment trusts as the board of directors or trustee members.

- Real estate investment trusts must abide by taxation regulations, ensuring their compliance and contribution to society.

PROS and CONS of The Real Estate Investment Trusts

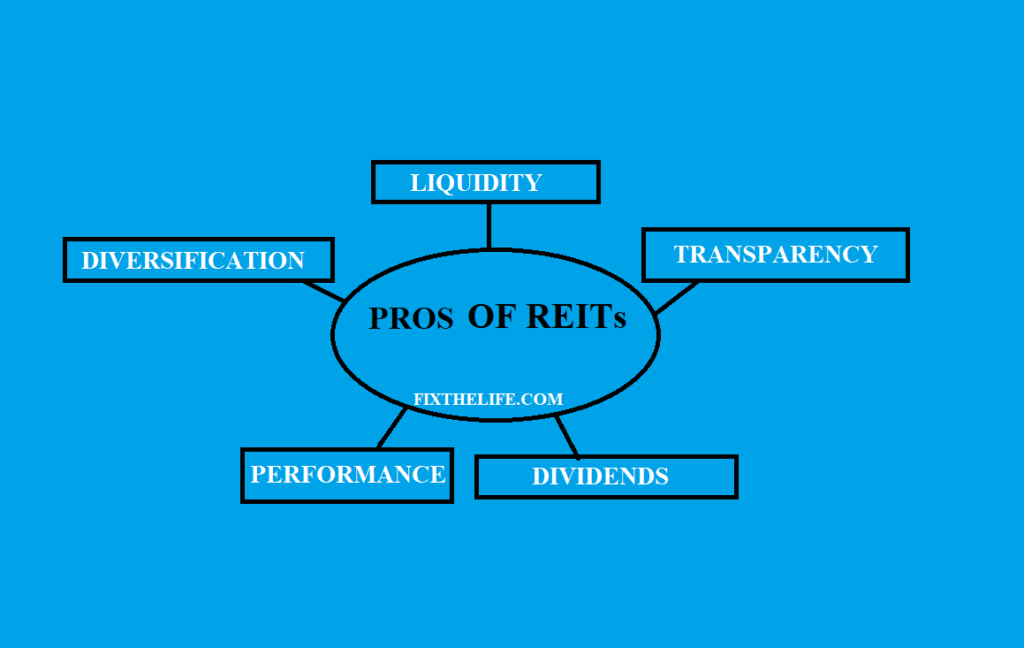

PROS of REITs

Those intrigued by the prospect of a career in real estate investment trusts must carefully weigh its advantages and disadvantages. By doing so, they can make an informed decision to ensure their success.

- Real estate investing can now be accessible to everyone, regardless of their financial situation. With this innovative model, individuals can reap great rewards with minimal financing.

- With REITs, you can easily and quickly access your money – just put up a few of your shares for sale on the market and receive a payment within days. Enjoy excellent liquidity when investing in real estate investment trusts.

- REITs are an increasingly popular investment option, and they only partner with the most seasoned real estate developers and managers who boast a record of reliably delivering loan repayments. This ensures that investors benefit from their investments in these tried-and-true experts.

- Diversifying your portfolio is now more accessible than ever with REITs. Investing in various commercial properties allows you to spread out risk and maximize returns for optimal financial success.

- Owning rental properties can be complex, but with the right tax preparation techniques, you could simplify your obligations for greater peace of mind.

CONS of REITs

- Investing in real estate investment trusts (REITs) can be profitable. However, there are some potential risks to consider. These include the illiquidity of investments and risk from downturns in the market or changes in regulations.

- Investing in real estate carries great responsibility, as lenders assume the risk that tenants may default on their rent or need to be evicted. In such cases, your mortgage debt would remain uncompensated by rental income.

- Real estate investments can be both rewarding and risky; their values fluctuate based on a number of factors such as economic conditions, governmental policies, and market trends. Knowing that the value of your property could change suddenly is important to consider when making real estate decisions.

- You could receive financial gain from someone else to take care of your debt and property. Relying on other people’s activities is key to generating revenue.

High Paying Jobs in Real Estate Investment Trusts

With a solid foundation of REIT knowledge in hand, it’s now time to explore the exciting career opportunities presented by real estate investment.

From asset management positions to direct investments and beyond – there are countless paths for successful professionals who want to make their mark in this dynamic industry.

Want to know if a real estate investment trusts a good career path? Understand what positions and salaries your chosen profession offers with this comprehensive breakdown.

Chief Operating Officer

JOB ROLE DESCRIPTION:

With the COO leading the way, projects are completed swiftly and efficiently – driving business operations forward. A highly-skilled team of junior operators is always ready to lend support when needed.

AVERAGE SALARY:

The average salary for a chief operating officer is $566,372 in November 2022 in New York, but it ranges between $440,518 and $734,143, making it one of the best paying jobs in real estate investment trusts.

Chief Finance Officer

JOB ROLE DESCRIPTION:

Companies with great CFO can enjoy the many benefits of an experienced business partner.

Their role is essential to achieving success by seeking out cost savings, taking advantage of tax incentives, ensuring staff are paid properly and on time, forecasting future growth opportunities, and planning investments with long-term goals in mind -all while maintaining financial health.

AVERAGE SALARY:

The average salary of a chief real estate officer is $283,200 annually, but it ranges between $234,680 and $366,840.

Chief Real Estate Executive Officer

JOB ROLE DESCRIPTION:

Even at the top of an organization, salaries still vary; however, it’s a safe bet that the CEO will always be rewarded handsomely for their expertise and leadership.

CEOs typically bring a wealth of knowledge to the table with over two decades of experience in their organization’s sector.

Their final decisions can significantly influence company performance and those they manage – making it essential to choose well-versed individuals for leadership roles.

AVERAGE SALARY:

A chief real estate executive officer’s average salary is $266,000 annually in November 2022, but it ranges between $218,800 and $341,900.

Real Estate Attorney- Average Salary: $142,049

JOB ROLE DESCRIPTION

Real estate attorneys are a must-have for any real estate investment trust (REIT).

They provide invaluable support in navigating the complex details of transactions to ensure that all parties interests are protected, as well as legal oversight regarding what goes on within REITs.

Real estate attorneys are a critical component of real estate investment trusts. They ensure that the legal facets of commercial properties, which often involve complex financial matters, are properly managed, and disputes minimized.

QUALIFICATION:

To become a successful real estate attorney, you need an impressive combination of skills and educational qualifications. It requires passing the Bar Exam and gaining an accredited law degree to enter this competitive field.

AVERAGE SALARY:

The attorney’s average annual salary ranges between $123K – 158K.

Property Manager – Average Salary: $127,774

JOB ROLE DESCRIPTION:

As a Property Manager in a REIT, you could hold the reins for everything from leasing and managing rentals to overseeing operations at multiple properties. No two days are ever alike, as each position brings its flavor of responsibilities.

QUALIFICATION:

There is no need but it is recommended to have a bachelor’s degree with past work experience.

AVERAGE SALARY:

The average salary of a property manager is $127,774 in November 2022 but ranges between $105,856 and $146,572.

ALSO READ: The BEST PAYING JOBS IN REAL ESTATE INVESTMENT TRUSTS

Assessing Real Estate Investment Trusts

- When considering investing in a real estate trust, there are several aspects to be aware of. Taking the time to evaluate these properly will help you make an informed decision and maximize returns on your investment.

- Investing in Real Estate Investment Trusts (REITs) provides an opportunity to generate long-term capital growth and healthy dividend yields. This makes them a great choice for those looking to achieve total returns with their investments.

- Explore the possibilities of real estate investment trust funds from operations (FFO) and discover how depreciation can overestimate a property’s decrease in value.

- Wise investments often favor established companies as they possess expertise from their tenured management teams.

- When seeking a real estate investment, ensure that any trusts you consider boast top-tier properties and reliable tenants.

- Investing in real estate investment trusts can be challenging, but with the right mutual fund or ETF, you get peace of mind and time-saving convenience. Invest wisely to achieve robust returns on your portfolio.

Skills You Must Develop to Join the REITs Industry

Joining the Real Estate Investment Trusts (REITs) industry requires more than simple ambition. Prospective employees need to possess a certain set of essential skills to succeed and reach their fullest potential.

You must possess the skills mentioned below:

- Basic knowledge of real estate

- Ability to understand financial statements

- Market research ability

- Asset & property management

- Passion for real estate and finance.

- Understanding of the financial models.

It is essential to have both soft skills and intricate market knowledge to ensure maximum return on investment. These two elements are key to doing business successfully.

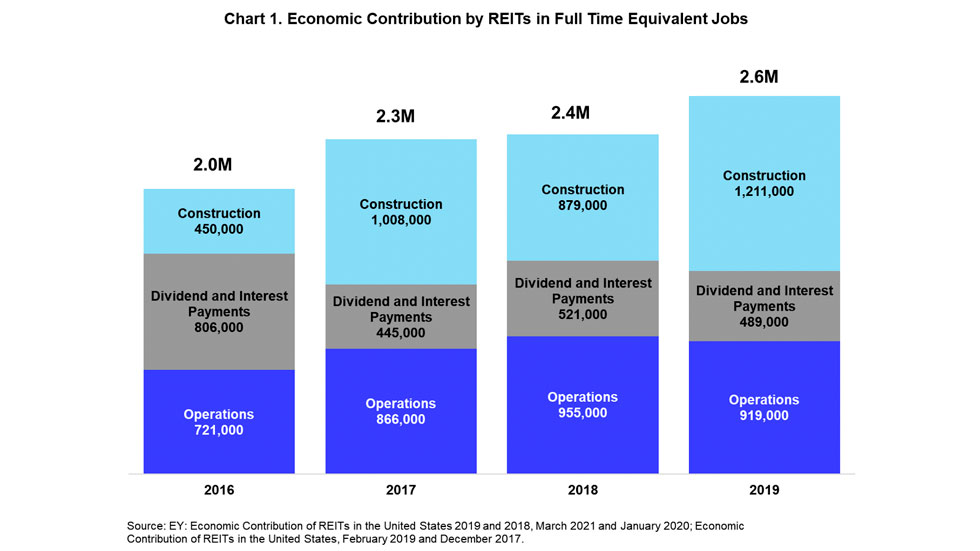

Real Estate Investment Trusts are an increasingly attractive career choice, with the U.S. actively promoting its immense potential. Statistical data show that it continues to prove its effectiveness in many ways, and opportunities for success are abundant.

CONCLUSION : Is Real Estate Investment Trusts A Good Career Path?

For those looking to enter the real estate market without buying physical property, Real Estate Investment Trusts (REITs) are an ideal option.

These investments require a combination of knowledge and financial understanding; if you possess both these qualities, REITs can prove incredibly profitable for your career in finance.

For potential investors, REITs have great profit-generating potential but come with risks. It is essential to contemplate goals and objectives before taking the plunge into this investment opportunity – a crucial step for success in any venture.

Real estate investment trusts allow individuals to pursue a career in the real estate industry without having to shoulder all of the risks.

This pathway offers investors access to the lucrative world of REITs while relinquishing any associated pressures, making it ideal for those with investing ambitions and keen insight into this dynamic sector.

Investing your valuable time can unlock the potential of compounding returns to generate a substantial income. Real estate investment trusts provide additional opportunities with greater direct involvement for those looking for something more hands-on.

With the right education and experience, individuals can become valuable members of productive teams. Leverage your knowledge to access exclusive opportunities – teamwork is within reach.

With real estate investment trusts providing an attractive career path, those looking to make a difference can help others create successful futures. Whatever area within the sector is chosen as your specialty, the following step may be where big opportunities lie.

REITs FAQs

Why is REIT a Good Career Path?

REITs and their third-party property management teams work together to identify valuable real estate investments, making it a full career path in the industry. By taking on senior roles involving multiple locations, you can make an impact while advancing your professional goals.

What Skills do I Need to Acquire to Become a REIT Agent?

To join the Real Estate Investment Trust community, you should bring more than just financial know-how to the table: communication proficiency in written and verbal forms is key.

Additionally, technical savvy and a background as a data analyst will be highly valued.

To complete this well-rounded skill set, prospective members are expected to have completed their bachelor’s degree with a specialization in finance or related fields like statistics, accounting, or real estate.

What are The Advantages of REITs?

Working for a REIT can open up an abundance of opportunities, from diversifying your career to gaining access to the power and potential of real estate.

Plus, REITs are renowned for their transparency and liquidity options – it’s no wonder why so many professionals choose this route.

Is Real Estate Investment Trusts a Good Career Path?

REITs offer an exciting career opportunity for those passionate about both finance and real estate.

With hard work, you can enjoy the benefits of substantial returns on your investment and valuable exposure to diverse areas within these two industries. Not only will REITs broaden your skillset but they could be a great addition to any resume.

Other Career Paths?

Is Integrated Oil Companies a Good Career Path? Best Jobs in Integrated Oil and Gas Industry

Best Paying Jobs In Integrated Oil Companies

Best Paying Jobs in Major Banks in 2023 – Highest Paying Bank Jobs

The BEST PAYING JOBS IN REAL ESTATE INVESTMENT TRUSTS

How Many Jobs are Available in Real Estate investment Trusts

How Many Jobs Are Available in Oil & Gas Production

25+ Best Paying Jobs in Oil & Gas Production – Oil Field Jobs

Is Oil & Gas Production A Good Career Path?

How Many Jobs are Available in Consumer Services : Complete Guide

IS CONSUMER NON-DURABLES A GOOD CAREER PATH IN 2023

How Many Jobs are Available in Consumer Non-durables

THE BEST PAYING JOBS IN MISCELLANEOUS IN 2023 🧑💼