Gen Amex Mlbasedfield – Technological advances are causing rapid changes in how we interact with the world. Gen Amex is a company at the forefront of using technology to change how we interact with the world. Gen Amex is a leading provider of advanced AI and machine learning solutions, with clients among the top names in the business world. They are revolutionizing the industry with their cutting-edge technology.

Understanding Gen Amex Mlbasedfield?

Gen Amex Mlbasedfield is an innovative version of American Express that assists with financial management and offers rewards. Gen Amex Mlbasedfield is a reloadable prepaid card that can be utilized anywhere American Express is accepted.

It can be used to make payments, buy goods and services, and make cash withdrawals. In addition to the card, Gen Amex also provides a mobile application that enables users to check their balance, transfer funds, and monitor their spending.

Transforming the Industry: The Advancements of Gen Amex Mlbasedfield

- Gen Amex is revolutionizing the industry by offering solutions that enhance financial security for individuals.

- Gen Amex provides a range of products and services that aid individuals in saving money and making informed financial choices.

- Gen Amex is dedicated to supporting individuals in enhancing their financial well-being and achieving their financial objectives.

ALSO READ: SQM Club : Everything You Need To Know About Facts & Benefits

Gen X is a group of 60 million grown-ups in America. They aren’t the largest group of grown-ups like the Baby Boomers or the Millennials, but they have more money to spend than any other group. They have 29% of the wealth in the country and earn 31% of all the income. This means they have a lot of power to buy things, even if they aren’t the largest group.

Gen X is a group of 60 million grown-ups in America. Some have a lot of money and are called “rich.” To be considered “rich,” they either make a lot of money as a family (more than $250,000) or have a lot of money saved up (more than $1 million).

About 36% of these “rich” Gen Xers make a lot of money, which is about 2 million people. And about 64% of them have a lot of money saved up, which is about 4 million people.

These “rich” Gen Xers are only a small part of the group, making up about 10% of all Gen Xers. But even the Gen Xers who aren’t “rich” make more money on average than either Baby Boomers or Millennials.

American Express’s History

American Express is a really old company that has been around for more than 160 years. At first, they just delivered mail, but now they help people with their money.

They joined forces with other companies like Wells & Company and Fargo & Company to become a big financial company. In 1891, they made something called the Traveler’s Check, which was helpful for people traveling.

During World War I, things were tough for everyone, but American Express helped by sending food, supplies, letters, and money to people stuck in Europe and prisoners of war.

American Express started as a company that helped people with their mail and bags while they traveled. But they wanted to do more, so they started helping people plan and go on trips too. They sent people to cool places like India, Europe, South Africa, and Asia.

In 1958, they made their first credit card and it was so good that a lot of people started using it. In just 5 years, they had a million credit cards being used.

In the 1970s, American Express got even bigger by buying other companies like Shearson Loeb and Lehman Brothers. This made them one of the biggest companies in the world, operating everywhere.

American Express bought some other companies long ago, but it didn’t work out like it thought it would.

So, in the 1980s, they decided to sell most of those companies and focus on what they do best: credit cards and helping people travel.

In 2014, they joined forces with a French company named Certares to run their travel business together. But a few years later, they decided to end the partnership.

How Does Amex Play?

American Express has found a unique spot in the money industry and is doing well. They have 107 million credit cards and handle 6 billion transactions a year, fewer than Visa does. But even though they have fewer cards and transactions, American Express earns more each year, with $33 billion compared to Visa’s $14 billion.

Advantages of Gen Amex

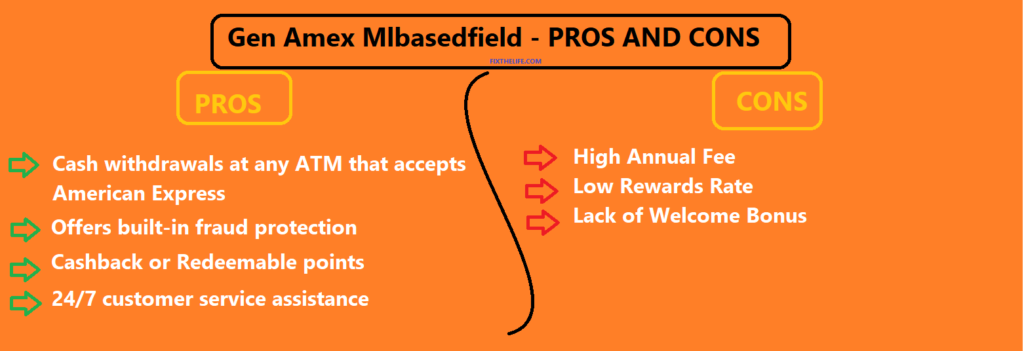

Using a Gen Amex card offers various advantages, including:

- The Gen Amex card can be used to make transactions anywhere American Express is accepted.

- The Gen Amex card also enables cash withdrawals at any ATM that accepts American Express.

- In addition, the Gen Amex card offers built-in fraud protection, providing a secure means for safeguarding your funds.

- Furthermore, Gen Amex cards offer a variety of rewards and benefits, such as cashback or redeemable points for travel and merchandise.

- Lastly, Gen Amex provides 24/7 customer service assistance for any needs, including canceling a lost card and answering any questions about your account.

Disadvantages of Gen Amex

Before committing to a Gen Amex card, it is important to consider the cost, including the annual fee of $450. Before opening a Gen Amex card, it’s worth noting that the animal fee of $450 is higher than most credit cards.

Additionally, the rewards rate is low at Only 1X Points per dollar spent. Lastly, this card offers no welcome bonus for the introductory APR period.

When searching for a new credit card, it may be beneficial to explore other options before committing to a Gen Amex card.

Due to its high annual fee, low rewards rate, and lack of welcome bonus or introductory APR period, more favorable options may be available.

FAQs

Q: Why is Amex so hard to get?

Getting an American Express credit card may take time as the company generally requires applicants to have good or excellent credit for approval. It is important to note that American Express is not the only credit card issuer that targets individuals with high credit scores.

Final Thoughts

To sum up, the American Express Green Card is an excellent choice for individuals searching for a rewards card that does not require an annual fee. The American Express Green Card is a valuable option as it provides a substantial welcome bonus and the ability to earn points on all purchases. There are various options available to redeem your points, which allows you to use them in a way that best suits your needs.

I hope now you know many things about Gen Amex Mlbasedfield.

ALSO READ:

Norstrat – What Is It’s Purposes and Services

Macbroo: The Apple Macbook Ecosystem Communities in The East

hawkfish mike bloombergfunded biden mayschleifervox