Today we take a deeper look at “How Many Jobs are Available in Real Estate Investment Trusts.” Why not explore the lucrative real estate market if you’re considering a career change? While starting your own business may be intimidating initially, working for an established REIT could offer a great opportunity to capitalize on this booming industry.

REITs offer investors a unique opportunity to tap into the lucrative real estate world without the hassle of traditional investment vehicles. By investing in an ETF that holds different REITs, savvy investors can diversify their portfolios for more optimal returns.

REITs offer a rewarding career path with increasing growth potential and generous remuneration.

They bolster economic activity through taxation and create new jobs while giving back to communities in the form of sustenance real estate improvements.

In this article, our experts have covered how many jobs are available in real estate investment trusts and how much they pay. So keep reading the article.

An Overview of Real Estate Investment Trusts

REITs are real estate investment trusts, allowing investors to access income-generating real estate without the hassle of traditional property ownership.

A REIT provides a smart and attractive way for new or experienced real estate investors to add diversity to their portfolios.

Investing in a Real Estate Investment Trust (REIT) is an attractive, high-yielding option for those looking to grow their portfolio.

REITs own and manage commercial real estate assets all around the country, generating income from rentals paid out as dividends to investors.

Investing in REITs is a savvy choice that offers potential rewards – dividends from rental income, mortgage interest, and capital appreciation.

These offer an attractive opportunity to benefit financially on multiple fronts.

How Many Jobs are Available in Real Estate Investment Trusts

Investing in a real estate investment trust allows individuals to access the potential profits generated from rental or lease payments on properties owned and operated by an industry leader.

They don’t have to buy any physical property, but it is still possible for them to share in the success of long-term real estate investments.

REITs, or Real Estate Investment Trusts, are a powerful contributor to the U.S. economy – providing an estimated 3.2 million full-time jobs in 2021 alone.

How Many are Real Estate Investment Trusts there?

Investing in real estate has never been easier with the advent of global Real Estate Investment Trusts (REITs).

Representing a collective $1 trillion equity market capitalization, REIT investments span various property types- from residential apartments to healthcare facilities and data centers.

The U.S. real estate investment market is booming with an array of options. Accessible to investors through one of the major stock exchanges are 225 registered REITs approved by the SEC.

But that’s not all; over 1,100 entities have filed tax returns with the IRS showing a vast selection of privately owned opportunities in this attractive niche field.

ALSO READ: How to Collect Unemployment Benefits

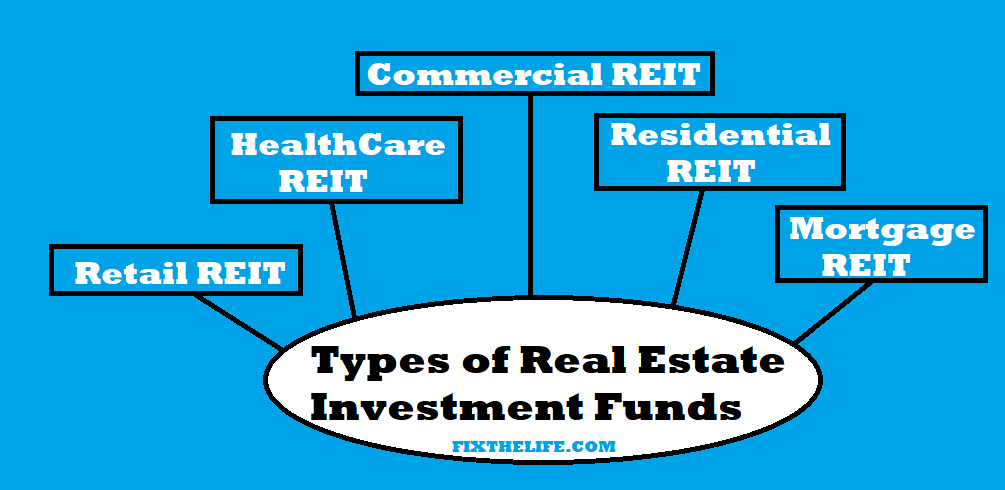

Types of Real Estate Investment Funds

Before diving into the world of job opportunities in Real Estate Investment Trusts, let’s take a tour through various sectors under their umbrella. From retail to medical office buildings and beyond – there is no shortage of industries that REITs cover.

- Retail REIT – Retail real estate investment trusts provide a home for shopping experiences, from small stores to bustling malls.

- HealthCare REIT – Healthcare real estate investment trusts are responsible for providing essential support and facilities to those in need, from hospitals to senior care centers and assisted living housing.

- Commercial REIT – Commercial real estate investment trusts allow clients to invest in a range of properties, from hotel complexes and office blocks to other commercial sites.

- Residential REIT – Residential Real Estate Investment Trusts (REITs) enable consumers to invest in apartment buildings, condominiums, and other rental properties – creating a pathway into the real estate market.

- Mortgage REIT – Real estate investments find their funding innovatively – through individual investors managed by mortgage real estate investment trusts. This allows various access to these powerful financial tools with fewer hassles than traditional bank financing methods.

What do People think of Jobs in Real Estate Investment Trusts?

With the real estate industry booming, opportunities abound for those in Real Estate Investment Trusts.

This field is dynamic and ever-evolving; if you’re looking to explore new avenues of professional growth, REIT may be just what you need.

With an expected 10% annual growth rate, the job market for real estate investment trusts is booming.

Aspiring REIT professionals have myriad options to break into this field and advance through it – 30 % of such jobs require business degrees while making entry-level positions available. Seize your chance now.

How Many Jobs are Available in Real Estate Investment Trusts

There are more than 2000 jobs available in real estate investment trusts on Indeed and 1000+ on LinkedIn.

Investing in Real Estate Investment Trusts (REITs) opens up a world of possibilities, from competitive salaries to abundant career growth opportunities.

With the variety available, now is an ideal time for professionals looking to start their journey in this thriving industry.

Common Jobs Available in Real Estate Investment Trusts

- Real Estate Sales Supervisor – 77,500+ Jobs.

- Property Manager – 117,500+ Jobs.

- Real Estate Administrative Assistant – 855,000+ Jobs.

- Real Estate Sales Associate – 150,000+ Jobs

- Real Estate Broker – 150,000+ Jobs.

- Real Estate Appraiser Roles – 33,500+ Jobs.

- Escrow Officer – 70,000+ Jobs

- Leasing Consultant – 62,500+ Jobs.

What Are The Best Paying Jobs In Real Estate Investment Trusts

Asset management is a lucrative career path, with salaries reaching upwards of $200K annually. Other well-compensated opportunities include developers and acquisitions roles and investor relations work.

Being well-versed in the world of REITs is key for success – after all, job roles and markets can intersect, intertwine and overlap.

With various industries, from construction to residential leasing, that offer employment opportunities within REITs, it’s vital to know what companies are looking for.

REITs are fast becoming a popular way of investing in the real estate market.

Backed by teams comprised of top-tier professionals such as asset managers, accountants, lawyers, and engineers who oversee every step from acquisitions to leasing — there’s never been an easier time to get involved with these lucrative investments that have traditionally carried high barriers to entry.

ALSO READ: THE BEST PAYING JOBS IN MISCELLANEOUS IN 2023 🧑💼

Types of Jobs in Real Estate Investment Trusts

There are tons of jobs available in real estate investment trusts, allowing workers to steer each step of property development projects.

From construction and management to operations and finance, REITs provide various stimulating career paths.

The company must stay dedicated to hard work and investment to remain competitive in today’s ever-changing market. A team of experienced specialists diligently manages every aspect of its portfolio for continued success.

Check out the list of jobs in real estate investment trusts:

- Construction Supervisor

- Property Manager

- Acquisition Team Member

- Commercial Developer

- Financial Analyst Marketing Coordinator

Different job positions come with different responsibilities and duties.

Real estate agents assist REITs in acquiring or disposing of properties, while property managers look after a building’s upkeep.

Financial analysts monitor an asset’s financial performance, and commercial developers design, build and manage retail spaces – all roles that share the common goal of ensuring profitability for companies big and small.

How Many Jobs are Available in Real Estate Investment Trusts

Real estate investment trusts open up various opportunities beyond being agents or property managers. Explore some leading positions, such as asset managers, portfolio strategists, and more, that can help you maximize your career in real estate.

Real Estate Sales Manager Roles

DUTIES:

As a real estate sales supervisor, I play an important role in helping agents make their mark within the REIT.

Through providing resources and support such as specialized training sessions, marketing advice, and listing knowledge, it’s my responsibility to equip them with what they need to succeed.

EDUCATION AND SKILLS REQUIRED:

Real estate sales supervisors require a mixture of qualifications to be successful in the role, namely a bachelor’s degree and experience within the industry.

In addition, as with all real estate agents, they must have an appropriate license from their relevant governing body. To top off these requirements, strong leadership skills are essential to excel at this managerial position.

AVERAGE SALARY:

Real estate sales supervisors enjoy an average annual salary between $60K and $80K, allowing them to take advantage of a secure financial position.

Leasing Consultant Roles

DUTIES:

Leasing and housing consultants facilitate landlords, property managers, and tenants to find an ideal living solution.

They are tasked with introducing potential renters to available properties, negotiating beneficial terms for all parties involved, and ultimately closing the deal by signing off on a lease agreement.

EDUCATION AND SKILLS REQUIRED:

Successful leasing consultants are smooth operators of property management — with a deep understanding of real estate and savvy sales skills to seal every transaction.

On top of that, these pros must excel at communication to tackle any challenge that comes their way.

AVERAGE SALARY:

With an annual average income of $46,933 and the chance to reap lucrative rewards from commissions and bonuses, a position as a leasing consultant is both financially rewarding and professionally stimulating.

Real Estate Asset Manager

DUTIES:

Asset managers have an immense role in the real estate investment trust industry.

They are tasked with ensuring that a portfolio’s fiscal well-being and operations run smoothly while also picking out assets capable of driving investments toward their desired outcomes.

Asset managers are the backbone of any successful organization. They coordinate between all departments while ensuring each function understands its objectives and roles.

EDUCATION AND SKILLS REQUIRED:

They must possess excellent communication skills and be capable multitaskers so they can seamlessly manage assets according to applicable regulations.

To succeed in this sector, it’s recommended to have a bachelor’s degree focused on either business or real estate and experience managing property or working with accounting processes.

AVERAGE SALARY:

A real estate asset management career can be financially rewarding, with an average annual salary hovering between $79K and $96K.

Real Estate Acquisition Manager

DUTIES:

Acquisitions professionals in the REIT landscape are essential in finding excellent opportunities and carefully crafting deals from inception to completion.

They are masters of due diligence and negotiation, ensuring that transactions come together and prove profitable for all parties involved.

EDUCATION AND SKILLS REQUIRED:

Successful candidates for the role of acquisition specialist must possess an invaluable combination of educational qualifications and experience that provide a deep-rooted understanding of all aspects of finance, as well as having poise under pressure when handling complex real estate transactions.

AVERAGE SALARY

Acquisitions careers in real estate investment trusts (REITs) can be highly lucrative, with an average salary of $98K – 140K per year.

Real Estate Property Developer

DUTIES:

Property developers act as project managers to ensure that real estate investments reach their full potential.

Their expertise in turning a simple plot of land into an exciting, profitable venture makes them invaluable for any investor looking to take advantage of lucrative opportunities in commercial and residential developments.

Developers partner with a range of experts to ensure successful project outcomes.

From contractors to financial planners, these professionals collaborate to secure assets and maximize results for businesses.

EDUCATION AND SKILLS REQUIRED:

An ideal candidate for this role has a degree in civil engineering, architecture, or urban planning and an impressive background in real estate.

Stellar communication skills are also essential to successfully collaborate with the stakeholders involved throughout each project.

AVERAGE SALARY:

The median salary for property developers is shy of $82K a year, offering an attractive opportunity to build success in the real estate industry.

Property Manager

DUTIES:

Property managers oversee the entire life of a real estate investment trust, becoming involved when it’s time to welcome tenants. From then on, they’re responsible for preserving and protecting all aspects of the property and its inhabitants.

EDUCATION AND SKILLS REQUIRED:

Property managers walk a tightrope of responsibilities, needing to be knowledgeable about real estate, finance, and communication – ensuring their property is well-maintained, and tenants are adequately screened.

It’s no wonder why these individuals must possess diverse capabilities if they hope to succeed in the field.

AVERAGE SALARY:

Break into the world of real estate with a solid foundation in business and related studies. An average salary between $87993 – $131,839 yearly may be potential remuneration for an applicant qualified to handle this role.

Real Estate Attorney

DUTIES:

Real estate attorneys are a must-have for any real estate investment trust (REIT).

They provide invaluable support in navigating the complex details of transactions to ensure that all parties interests are protected, as well as legal oversight regarding what goes on within REITs.

Real estate attorneys are a critical component of real estate investment trusts. They ensure that the legal facets of commercial properties, which often involve complex financial matters, are properly managed, and disputes minimized.

EDUCATION AND SKILLS REQUIRED:

To become a successful real estate attorney, you need an impressive combination of skills and educational qualifications. It requires passing the Bar Exam and gaining an accredited law degree to enter this competitive field.

AVERAGE SALARY:

The attorney’s average annual salary ranges between $123K – 158K.

Property Appraiser Residential Real Estate Jobs

DUTIES:

Real estate investment trusts depend on the expertise of qualified property appraisers to assess a potential addition.

Appraisal professionals are tasked with identifying fair market values and providing insight on the viability of any real estate investments, giving proper direction in financing or other aspects of an acquisition process.

EDUCATION AND SKILLS REQUIRED:

To become a real estate appraiser, you need more than just extensive industry experience and financial expertise – it takes proper education and licensure for each state.

On-the-job training is required to gain the full knowledge necessary to perform this essential professional role.

AVERAGE SALARY:

Real estate appraisers can enjoy competitive yearly wages of up to $57,582. On average, they receive an annual salary of between $47,435 and $66,562.

Real Estate Investment Trust Analyst Roles

DUTIES:

Real estate investment trust analysts are indispensable stewards of REITs, ensuring the long-term success and stability of investments through close collaboration with real estate and financial departments.

With their skillful management expertise, they’re instrumental in pinpointing ideal opportunities to buy, sell or retain prime real estate assets.

EDUCATION AND SKILLS REQUIRED:

An analyst in the REIT industry requires a special combination of financial acumen and real estate expertise. This role is ideally suited for professionals with a bachelor’s degree in finance and extensive experience in this sector.

AVERAGE SALARY:

Analytical minds are both valuable and well-rewarded. Analysts leverage their research skills to obtain salaries ranging from $76,988K – $109,182K annually, providing a solid foundation for the future.

How Can You Become a Professional in Real Estate Investment Trust?

Financial success requires strong analytical and interpersonal skills, plus the ability to recognize potential investments. Successful candidates will have a background in financial analysis, accounting, and investing.

They must also demonstrate superb communication abilities – because building relationships with clients, investors, and industry peers is essential for long-lasting success.

If you are considering taking the plunge and becoming a real estate investment trust professional, it’s essential to make sure this is the right career choice for your future.

The advantages of working in REITs can be plentiful; however, before moving forward, ensure you have contemplated all aspects necessary to tackle these responsibilities head-on.

There are some basic steps you need to know if you have decided on what career path you chose.

Getting educated is the foundation of any successful real estate investment journey. Access top-tier resources and find a mentor to guide you along your way – this will give you an edge in building connections and accelerating your success.

Take advantage of available courses, programs, or conferences that can get you networked with key players who can help launch (and maintain) momentum as you pursue money-making opportunities through property investing.

With the proper research and preparation, a career in real estate investment trusts (REITs) can be incredibly rewarding.

There are abundant opportunities available; finding the right job is key to unlocking your potential. With diligence and dedication, you’ll soon enter this lucrative industry with confidence and success.

Requirements to work in a Real estate Investment Trust Firm

Working in a Real Estate Investment Trust company requires more than just the dream of owning property.

It takes an experienced professional with knowledge and expertise in business, finance, or economics and experience within the real estate industry.

Those seeking to break into this competitive field may also benefit from various related disciplines such as accounting, investment banking, or law training.

In order to join a REIT team, you must have an unwavering commitment and enthusiasm for real estate investing.

You should also be prepared with the time, energy, and resources necessary to stay ahead in this competitive industry.

Most importantly, though, your values must align seamlessly with those set by the company itself – to ensure success at every turn.

Real estate can be daunting, but REITs allow investors to get involved with the market. To ensure success and protect yourself from potential risks, you must have extensive knowledge of this field before getting started.

REITs are an attractive investment option for those looking to benefit from regular dividend payments, as they must pay out 90% of their taxable income annually.

However, there is a limit on the number of shareholders REITs can have – no more than 50%, with five or fewer people holding that majority stake.

How Much Can You Make Working in The Real Estate Investment Trusts?

Smaller companies may offer opportunities for entry-level positions. In contrast, larger corporations are often able to provide more lucrative job roles due to their greater financial stability and the complexity of tasks required.

The REIT industry offers an attractive compensation package, with the average base salary coming in at $75,000 annually – well above the median wage for other industries.

So why take advantage of this great opportunity and explore what the real estate investment trust sector offers?

Lead Analysts and Senior Analysts are two of the best paying jobs in real estate investment trusts, boasting generous salaries ranging from $80K to $90K across national markets.

Salaries may vary based on region; for those seeking a prosperous career with promising financial gains, this sector is worth exploring.

Executive-level positions are the pinnacle of career success, offering incredible earning potential. On average, senior executive salaries exceed $100K – and that’s not all: these high earners often get an ownership stake in their company too.

PRO TIP: Choose to work for a big name in the sector to make your bank grow.

How Many Jobs Does the Real Estate Investment Trusts Sector Offer Per Year?

The job market for Real Estate Investment Trusts (REITs) is booming, with an estimated 1,000+ new positions annually. REITs are a great way to kick-start or further your career in real estate investment.

The number of jobs in real estate investment trusts is increasing day by day.

Investing in a Real Estate Investment Trust (REIT) can open the door to many exciting and lucrative career options – each with different responsibilities, benefits, and salaries.

Prospective applicants should thoroughly research all aspects of their desired role before making any decisions.

With so much opportunity available within this industry sector, it’s worth taking time to ensure you choose an option that best suits your capabilities and interests.

From accountants to property managers, REITs offer an array of exciting career chances for those who want to join the industry.

Working in a diverse role, such as a leasing consultant or financial analyst, can help you develop your skills and grow professionally. Explore what positions are right for you today.

Frequently Asked Questions

Are Real Estate Investment Trusts Common?

Investing in real estate is no longer a dream reserved for the wealthy. With REITs, everyday investors now have ready access to trustworthy real estate investments — an ideal way of diversifying and strengthening portfolios.

How Many Roles Are Being Created in the Real Estate Investment Trust Field?

With over 200 REITs to choose from, the real estate investment trust industry is an ever-expanding sector with many employment opportunities.

From property management and appraisal to research analysis and asset oversight – there’s sure to be a role that aligns perfectly with your career aspirations.

Why REIT Jobs Are Popular Among People?

For real estate professionals, the REIT industry is a unique opportunity to take their career growth further than they thought possible.

With new paths for promotions and success available now more than ever, there’s no reason your current position has to be where you stay – make sure you’re taking full advantage of all these chances.

Do REIT Jobs Have Growth and Stability?

REITs bring another dimension to real estate jobs by offering stability and growth potential. With the increasing popularity of REITs, increased job opportunities have become available in an ever-expanding industry that has provided reliable employment for years.

What Do I Do to Get a Job in REIT?

To make a successful start in the Real Estate Investment Trust (REIT) sector, you’ll need the right educational qualifications and prior experience.

A Bachelor’s degree combined with relevant real estate knowledge can open up exciting opportunities to work within this fascinating industry.

How Many Jobs Are Available in Real Estate Investment Trusts?

With a rewarding career in real estate investment trusts, there are plenty of opportunities for those with varied interests. Unlock the door to financial freedom and discover your path by signing up today. Visit our blog to learn more about how you can get started on an exciting journey toward success in real estate investing.

Other Career paths

Is Integrated Oil Companies a Good Career Path? Best Jobs in Integrated Oil and Gas Industry

Best Paying Jobs In Integrated Oil Companies

IS REAL ESTATE INVESTMENT TRUSTS A GOOD CAREER PATH?

The BEST PAYING JOBS IN REAL ESTATE INVESTMENT TRUSTS

Best Paying Jobs in Major Banks in 2023 – Highest Paying Bank Jobs

How Many Jobs Are Available in Oil & Gas Production

25+ Best Paying Jobs in Oil & Gas Production – Oil Field Jobs

Is Oil & Gas Production A Good Career Path?

How Many Jobs are Available in Consumer Services : Complete Guide

IS CONSUMER NON-DURABLES A GOOD CAREER PATH IN 2023

How Many Jobs are Available in Consumer Non-durables

THE BEST PAYING JOBS IN MISCELLANEOUS IN 2023 🧑💼