Best Paying Jobs in Major Banks in 2023 – Highest Paying Bank Jobs. When looking for a high-paying career, consider the possibilities within the banking industry. Major banks are known for offering lucrative job opportunities in a highly competitive field.

The banking industry is known for its strong competition, even at entry-level positions. Achieving success in this field typically requires starting at the bottom and gradually working your way up. The most sought-after and best paying jobs, such as chief executive roles and positions as investment professionals at hedge funds, are particularly difficult to secure.

In the following section, we will highlight the best paying jobs in major banks and the benefits of working in this industry.

What is a Major Bank?

A “major bank” refers to any institution that meets the following criteria:

- It is a Federal Reserve Bank or one of its branches.

- Some examples are Chase Bank, Credit Suisse, JPMorgan, and Deutsche Bank AG.

- It is a bank or trust corporation incorporated in the United States or any of its states.

- It has a combined capital and surplus of at least $100 million.

What Are The Highest Paying Jobs in Major Banks?

- Accounting Manager

- Accountants and Auditors

- Branch Managers

- Budget Analyst

- Credit Analysts

- Chief Financial Officer (CFO)

- Equities Trader

- Financial Analyst

- Investment Bankers

- Loan Officers

- Portfolio Manager

- Tellers

Is Banking and Finance A Good Career Path?

The banking and finance industry offers a wealth of opportunities for those who are up for a challenging and rewarding career. With the ever-evolving technology trends, being a finance professional with a good grasp of technology is becoming a highly sought-after skill set, making it an attractive career path.

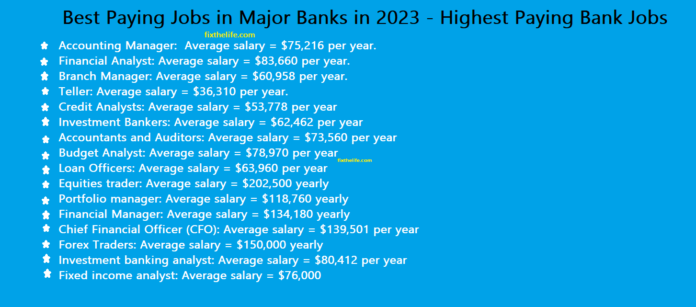

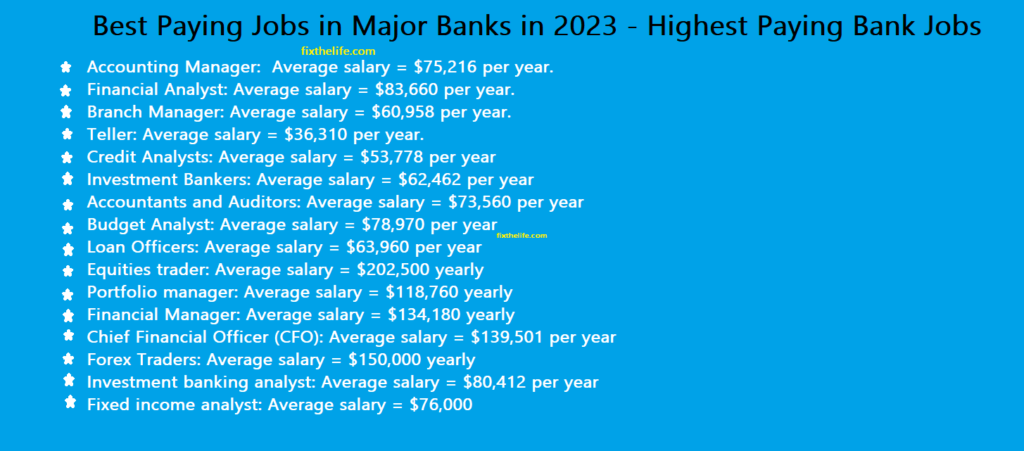

Best Paying Jobs in Major Banks in 2023 – Highest Paying Bank Jobs

Which banks in America are considered the most secure?

Some of the banks that are often considered to be among the most secure in America include:

- JPMorgan Chase

- Citibank

- U.S. Bank

- Wells Fargo

- PNC Bank

Is banking a good career path?

A career in banking is considered a good choice, as it offers several benefits like career growth opportunities, an attractive benefits package, professional networking, competitive compensation, and a good work-life balance.

Which job in banking offers the highest pay?

The chief financial officer (CFO) position is typically considered one of the most well-paying positions in the banking industry. With an average base salary of $139,501 per year, CFOs are highly sought after for their expertise and experience. Remember that CFOs can also be found in other industries, not just banking.

What are the highest paying bank jobs?

Some high paying positions include:

Financial Analyst, Financial Examiner, Credit Analyst, Investment Banker, Branch Manager, Loan Officer, and Accounting Manager.

What are the key skills required for a career in banking?

A successful career in banking typically requires strong attention to detail and excellent analytical skills. Additionally, strong math and communication skills and the ability to work well under pressure are often important in the field. Some positions may also require specific certifications or licenses.

ALSO CHECK: Fixthelife Career path Series Brings you Best Paying Jobs in All Industries

What Are The Best Paying Jobs In Major Banks In 2023?

Accounting Manager: with an average salary of $75,216 per year.

In this role, you will be responsible for ensuring the accuracy and timeliness of financial reports. You will also be tasked with creating periodic activity reports and an annual budget proposal for upper management. Additionally, you will be accountable for maintaining the company’s financial records to be accurate and up-to-date.

Financial Analyst: with an average salary of $83,660 per year.

Financial analysts are professionals whose primary responsibility is conducting financial analysis for clients within and outside the company. Job titles within this field can vary and include roles such as securities analyst, research analyst, equity analyst, investment analyst, rating analyst, or similar. Financial analysts are responsible for evaluating financial data to provide guidance and advice to management or clients. A bachelor’s degree in finance or economics is typically required to enter this profession.

3. Branch Manager: with an average salary of $60,958 per year.

As a Branch Manager, you will be an executive responsible for supervising a division or office of a large corporation or organization that operates within a specific geographical location or purpose. Your responsibilities will include the following:

- Managing resources and personnel.

- Setting and achieving sales objectives.

- Delivering excellent customer service.

- Increasing the location’s revenue.

4. Teller: with an average salary of $36,310 per year.

As a teller, your primary responsibilities will include handling cash and other negotiable instruments for customers and providing general customer assistance in a bank branch. You may also be referred to as a cashier or customer service representative. Teller positions usually require at least a high school diploma and can provide good pay and various benefits.

Credit Analysts: $53,778 per year

A credit analyst is a professional who works for a company and is responsible for assessing the financial stability of current and potential clients. They assist in managing and analyzing credit risk as well. They gather and analyze financial data on loan applicants, such as their past payment behaviors, income, savings, and expenses. Based on this information, the credit analyst will recommend approving or denying the loan.

Investment Bankers: $62,462 per year

Investment banking is a type of financial service that involves advising and carrying out financial transactions on behalf of individuals, corporations, and governments. This includes underwriting and issuing securities, which helps clients raise capital. Investment bankers are the financial professionals who perform these tasks.

Accountants and Auditors: $73,560 per year

At major banks, accountants and auditors play a crucial role in maintaining the financial health of their companies. Their responsibilities include:

- Verifying the accuracy and compliance of financial statements.

- Reviewing financial records.

- Identifying potential risks and opportunities.

- Providing solutions to organizations and individuals.

They are tasked with ensuring that the financial records of their companies are in order.

Budget Analyst: $78,970 per year

Budget analysts are responsible for examining budget proposals to determine the most efficient use of funds for a project. Their duties include reviewing budget proposals and funding requests, evaluating spending requirements, and conducting cost-benefit analyses. They play a key role in identifying ways to allocate funds effectively and providing solutions for maximizing the use of budgeted money.

Loan Officers: $63,960 per year

Loan officers assist customers with obtaining loans or mortgages and work with them to establish loan repayment terms. They evaluate the financial information of prospective borrowers to determine their eligibility for a loan. The primary responsibility of a loan officer is to evaluate, approve and recommend loan applications from individuals and businesses. They guide the clients throughout the process and provide the necessary advice.

Equities trader: $202,500 yearly

Equity traders are highly-compensated professionals in major banks. They play an important role in the financial sector by facilitating the buying and selling a company’s stock. These traders are often considered the highest paying jobs in the banking sector. It is one of the best paying jobs in major banks.

Portfolio manager: $118,760 yearly

As a portfolio manager, you are responsible for determining where to allocate your clients’ funds into investments. This requires ongoing evaluation of market trends, company performance, and stock prices to make informed decisions. Working in a bank as a portfolio manager can also lead to high compensation.

Financial Manager: $134,180 yearly

As a financial manager, you are responsible for ensuring the financial well-being of an organization. This includes creating financial reports, managing investments, and developing plans to achieve the organization’s long-term financial goals. Additionally, you are tasked with preparing financial reports and creating both short-term and long-term financial strategies.

Chief Financial Officer (CFO): $139,501 per year

As a high-level executive, the chief financial officer (CFO) is crucial in managing a company’s finances. This includes monitoring cash flow, creating financial plans, and identifying both the strengths and weaknesses of the company’s finances. The CFO then provides recommendations for addressing any issues that are identified.

Forex Traders: $150,000 yearly

Forex trading is considered one of best paying jobs in major banks. These professionals specialize in buying and selling foreign currencies, working to generate profits. Large banks or trading firms typically employ them.

Investment banking analyst: $80,412 per year

Investment banking analysts pay close attention to financial sponsors who operate within the infrastructure industry. This encompasses sectors such as transportation, utilities, energy, and telecommunications. They often participate in a diverse array of industries and execute different types of deals, such as sell-side and buy-side transactions.

Fixed income analyst: $76,000

Fixed-income analysts are responsible for selecting the investments that comprise the fixed-income portion of a portfolio. They evaluate the value of underlying securities, make investment recommendations, and monitor their performance.

Skills necessary for obtaining jobs in the banking sector include the following:

To secure the best paying jobs in major banks, certain skills are considered essential.

Communication skills

As in many other fields, effective communication is a highly valued skill in the banking industry. This is particularly true for high-paying jobs within major banks. Clear and concise communication is vital for success in the workplace, and this is particularly true in the banking sector.

Customer service skill

In the banking industry, exceptional customer service abilities are crucial for success. This includes a combination of both effective communication and problem-solving skills. These core abilities are necessary for the likelihood of success in the banking sector to be greatly improved.

Analytical skills

To progress in banking and finance, it is essential to possess strong analytical skills to identify trends and patterns and make informed conclusions from large amounts of data. Without these abilities, it cannot be easy to succeed in the industry.

ALSO READ:

Is Integrated Oil Companies a Good Career Path? Best Jobs in Integrated Oil and Gas Industry

Best Paying Jobs In Integrated Oil Companies

IS REAL ESTATE INVESTMENT TRUSTS A GOOD CAREER PATH?

The BEST PAYING JOBS IN REAL ESTATE INVESTMENT TRUSTS

How Many Jobs are Available in Real Estate investment Trusts

How Many Jobs Are Available in Oil & Gas Production

25+ Best Paying Jobs in Oil & Gas Production – Oil Field Jobs

Is Oil & Gas Production A Good Career Path?

How Many Jobs are Available in Consumer Services : Complete Guide

IS CONSUMER NON-DURABLES A GOOD CAREER PATH IN 2023

How Many Jobs are Available in Consumer Non-durables

THE BEST PAYING JOBS IN MISCELLANEOUS IN 2023 🧑💼